JUST IN: NNPCL’s $3bn Afreximbank Deal Intact, Can Never Collapse ‘—-Kyari

…Says Fuel Subsidy Would Have Risen To N1trn Monthly If Not Removed

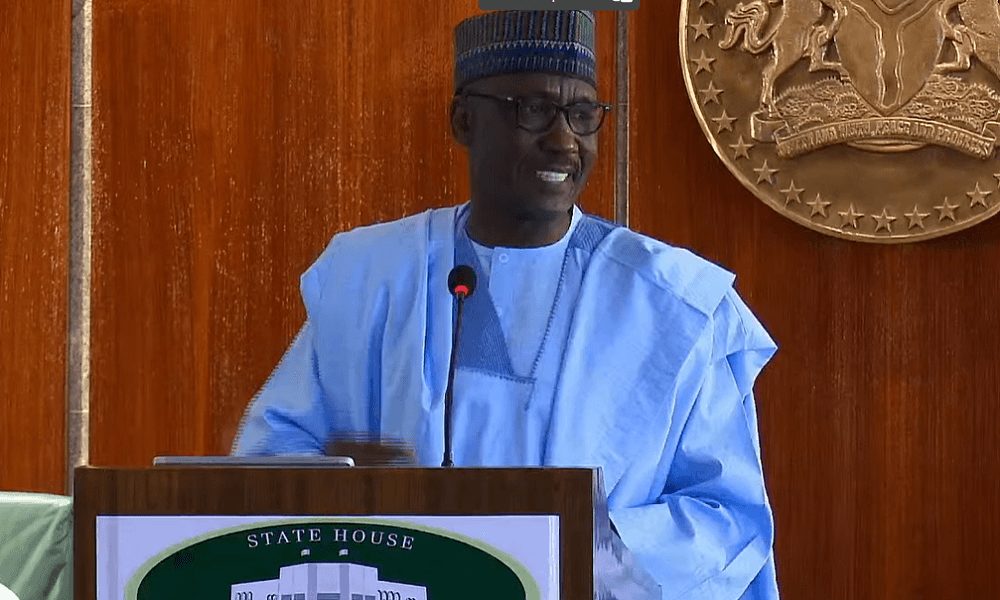

The Group Chief Executive Officer of the Nigerian National Petroleum Company Ltd, Mele Kyari has said that the $3bn forward sales deal between the National Oil Company and the African Export-Import Bank is still intact.

Advertisement

The NNPC Boss made the clarification on Friday at the State House briefing in Abuja monitored by THE WHISTLER.

As Nigeria’s foreign exchange crisis heightened due to FX shortages to meet up with demands from the market, the NNPC entered a deal on August 16 with Afreximbank to secure $3bn which will be sold to the Central Bank of Nigeria to intervene in the forex market.

Foreign exchange pressure had led speculators to trade the naira at N920 per dollar on the black market while the official window closed at N762.71 on August 31 2023.

The deal was lauded by foreign institutions like JP Morgan Chase & Co and several Nigerian analysts, who said the $3bn is a quick fix that would alleviate the FX situation.

Advertisement

However, media reports (NOT THE WHISTLER) had claimed that the $3bn deal had been terminated, adding that Afreximbank cannot provide the $3bn requested by the NNPCL.

But reacting to the development, Kyari said, “With the growing market and the prices that are good today, we know that the FX stability is well within sight, and NNPC is already making some FX payment into the transaction account.

“This is also a good moment to respond to a number of media conversations that is going on around the Afrexim bank loan, that it has collapsed and is no longer going to be possible. It is not a loan. It is a forward sale, and forward sales are easy deals.

“You are simply selling your item for tomorrow, and banks don’t have problems funding this. So, this is not a type of transaction that will ever collapse when it is fully clear that the volume that you are selling is already on the table and it is known to your partners.

“May I also point out that the industry, which is clearly a major source of FX for the country, as long as you don’t produce and export, you will continue to rely on exports coming from the only source of foreign exchange and this will grow as long as production grows and the market remains stable. But this industry can’t grow except some enablers are in place.”

Advertisement

The NNPC boss further explained that the Nigerian oil industry is in a position to provide all the necessary forex needed for transaction in the country as crude oil production has reached 1.67 million barrels per day.

According to the NNPC Boss, the improved production gives NNPCL the firepower to sell more dollars to the apex bank for FX intervention.

He said, “The oil and gas industry has a huge potential and possibility of providing all the foreign exchange requirements of this country. We can’t do this except we are able to produce and also take into the market because we did have substantial challenges of security which I also confirm at this moment that Mr President has reengineered the security approach.

“We are already seeing very significant changes in our production environment, and just checking the data for Wednesday, August 29, 2023, actual data for crude oil and condensate products is at 1.67 million barrels per day.

“This is substantial if you look at the situation where we were almost below a million barrels per day some months ago.

“The connection of this to subsidy is that you cannot give what you don’t have. As at the time Mr President took over, precisely May, 29, we were actually at the point of default, and NNPC was facing imminent illiquidity because we kept carrying the subsidy burden. The Federation and the sub-nationals are unable to pay their bills for the subsidy.

Advertisement

“That means NNPC was carrying the subsidy burden for the whole nation until it became very obvious by the time Mr President took over that it is no longer possible to proceed because we do not have cash to pay for it and NNPC could potentially go into bankruptcy, and it was impossible to continue. So, it wasn’t even a matter of preparedness. You can’t do what you can’t afford.”

He revealed that with the current prices of crude oil in the international market and the country’s current FX pressure, fuel subsidy would have risen to N1trn monthly.

According to him, the evacuation of fuel by the NNPCL has fallen by 30 per cent which implies that the oil company would spend less FX to import PMS.

He said the forex saved as a result would be channeled to the CBN for forex intervention.

Kyari revealed, “The subsidy burden was about N400bn every month and if this situation had continued, with today’s market condition and FX regime, we would have been dealing with close to a trillion naira of subsidy every month at this point in time and we simply don’t have those resources anymore. We are not just saving money; we are also placing realities around what we can afford.

“As a result of that change, we saw demand go down by around 30 per cent. That means we used to do 66.7 million litres as at 29th of May and as we speak today, we only do 46 million litres of evacuation in the country, including cross-border leakages I must admit but this is the reality we are facing.

“We have seen a 30 per cent decline in total volume of PMS that is consumed in this country. This also means the reduction of 30 per cent of foreign exchange requirements. It means that whatever we have that we must put forward to provide PMS will be available to shore up our FX environment.”