The International Monetary Fund (IMF) has advised the Central Bank of Nigeria (CBN) to pay up the remaining $2.2bn forex forward backlogs owed investors.

The IMF is happy with the current monetary policy rate tightening, floating of the naira and discontinuation of unorthodox interventions adopted by former CBN Governor, Godwin Emefiele, according to the post financing assessment with Nigeria conducted by the Executive Board of the IMF.

Advertisement

The IMF said, “The CBN has set out on a welcome path of monetary tightening. The Governor has committed to making price stability the core objective of monetary policy, and the CBN has taken actions to mop up excess liquidity.

“Continuing to raise the monetary policy rate until it is positive in real terms would be an important signal of the direction of monetary policy. The authorities are exploring options to strengthen Nigeria’s reserve position, though a careful assessment of unintended consequences is needed in some cases.

“Settling the CBN’s overdue dollar obligations will help rebuild confidence in the central bank and the naira. Sharing comprehensive information on Nigeria’s reserves position would facilitate a more complete assessment of the external situation.”

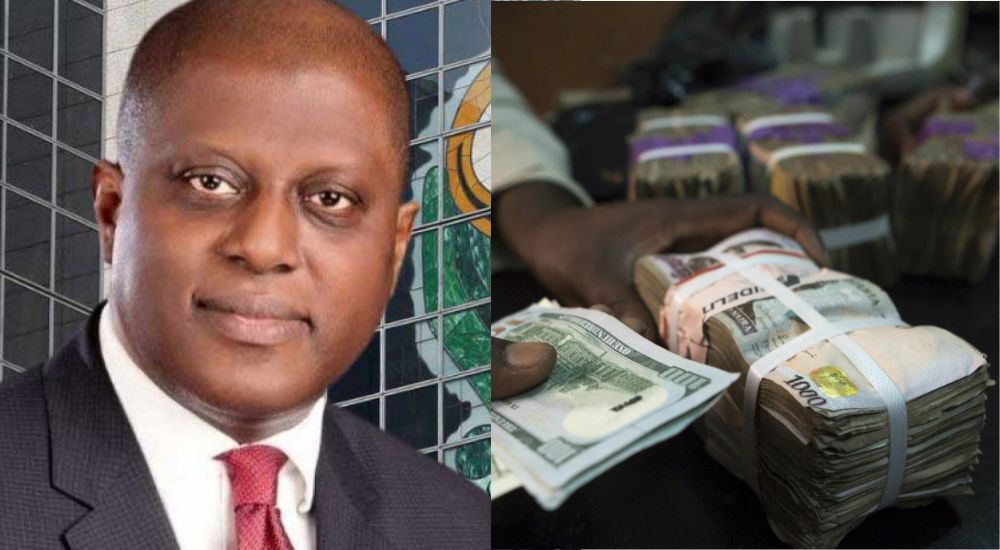

The CBN Governor, Olayemi Cardoso said he inherited about $7bn forex backlogs out of which $2.4bn are illegitimate.

Cardoso revealed that the apex bank has settled $2.3bn of the legitimate backlogs and has an outstanding of $2.3bn.

Advertisement

“We were committed to ensuring that we would pay all valid transactions. We discovered that of the $7bn (backlogs), about $2.4 had issues which we believed had no business being there and the infractions on that range from so many things,” Cardoso had said in a recent interview.